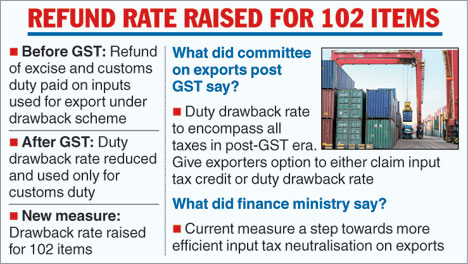

Recently the GST authorities found that exporters are misusing the government’s duty drawback scheme (DDS) by claiming it along with refunds of integrated goods and services tax (GST).

Why in news?

Over 100 such exporters mainly in apparel, drugs, and leather have been “illegally” drawing benefits from two routes.

What is the Duty drawback scheme ?

Under this scheme, exporters are provided with a refund of customs duty paid on unused imported goods, or goods that will be treated, processed or incorporated into other goods for export.

Claims must be lodged within 4 years from the date the goods were exported.

Duty drawback can be only claimed for compensating unrebated taxes and duties, not for GST.